Table of Contents

- New Jersey's Minimum Wage Hike To .13 In 2024: What Employers And ...

- 2024 Minimum Wage Increases - Nextep

- Minimum Wage Updates Effective January 1, 2024 – C2 Essentials, Inc

- INCREASES_ON_MINIMUM_WAGES_ACROSS_THE_BOARD_INCREASES_AND_ALLOWANCES ...

- 2024 Minimum Wage Increase in New York, New Jersey, and Connecticut ...

- 2024 State and Local Minimum Wage Increases: What Employers Need to Know

- 2024 State and Local Minimum Wage Increases: What Employers Need to Know

- Wage rates and allowances increasing from 1 July 2024 | NatRoad

- Minimum Wage: Which States Are Increasing It This Year?

- Nearly 10 million workers in 22 states will see boosts to minimum wage ...

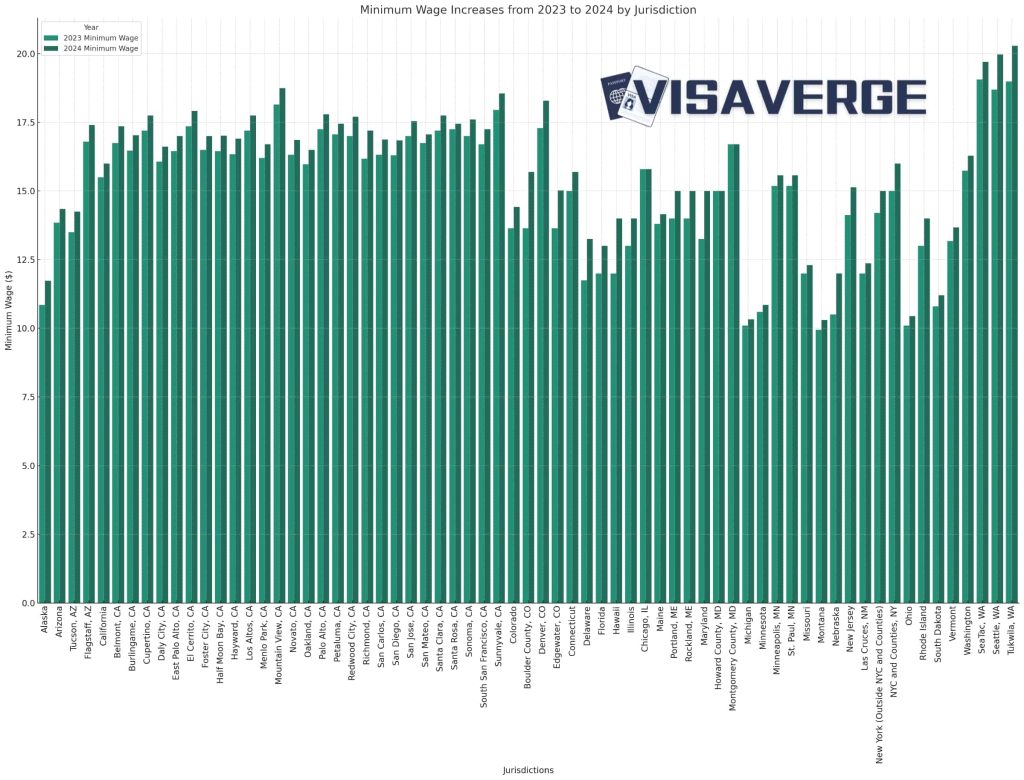

Understanding the Minimum Wage Changes

Key States and Cities Affected

- California: $15.50 per hour for employers with 26 or more employees

- New York: $15.00 per hour for most employees

- Illinois: $14.25 per hour for employers with 4 or more employees

- Massachusetts: $16.65 per hour for most employees

- Seattle, WA: $18.69 per hour for large employers

Implications for Employers

The minimum wage changes will have significant implications for employers, including:- Increased payroll costs: Employers will need to adjust their budgets to accommodate the higher minimum wage rates.

- Compliance requirements: Employers must ensure that they are complying with the new minimum wage laws, including posting updated notices and maintaining accurate records.

- Employee benefits: Employers may need to review and adjust their employee benefits packages to ensure that they are providing fair and competitive compensation.

Preparing for the Changes

To prepare for the minimum wage changes, employers should:- Review their current payroll practices and budgets

- Update their employee handbooks and policies

- Provide training to HR staff and managers on the new minimum wage laws

- Communicate the changes to employees and ensure that they understand their rights and benefits

Stay ahead of the curve and ensure that your business is ready for the minimum wage changes. Contact us today to learn more about how we can help you navigate these updates and maintain a successful and compliant business.